Fraud Detection

Mitigate risks, reduce losses and ensure rich customer experience with accurate prediction of fraudulent transactions in real-time

Fraud in the financial services industry is a long-standing problem that needs sophisticated methods to prevent and manage. It adversely affects customer loyalty and results in the loss of value/affinity. Hence, modern financial institutions are looking for fraud prevention solutions that are non-intrusive and don’t disturb customer experiences.

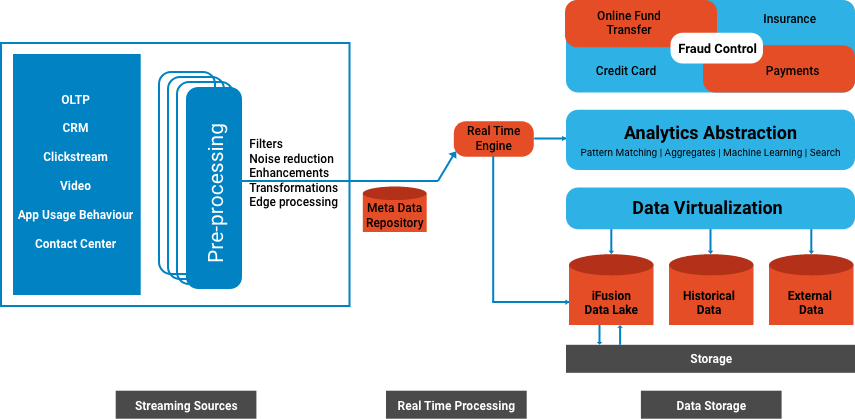

iFusionTM solution for fraud enables banks and financial organizations to analyze, detect, and prevent fraud using advanced analytics and sophisticated machine learning models. It provides a risk-scoring methodology to highlight the likelihood of fraud, attribute fraud to the underlying change in behavior, and provide reasons for fraud.

Features

Cross-source intelligence data compliant

Ability to combine data from multiple systems and various formats through data virtualization and feature extraction, which improves risk scoring and provides a rich context for fraud investigators

Out-of-the-box fraud scenarios

Provides a rich set of configurable scenarios based on the behavioral patterns of the transactions, usage, and user dimensions to detect anomalous or suspect behavior

Comprehensive suite of advanced ML techniques

Supports a range of anomaly detection techniques, including sophisticated deep learning methods to model for fraud even at low signal-to-noise ratios (< 0.1%)

Insightful visualizations on fraud

Provides fraud visualization to understand the risk from various dimensions and also to gain insights into the behaviors or patterns that are causing fraud

Fraud prevention through timely intervention

Automatically stops high-risk transactions to prevent losses and allows the low-risk transactions to minimize the impact on customer experience

Benefits

Reduces fraud losses and risk with exposure to a variety of fraud scenarios

Performance at high velocity and volumes of data in a scale-out fashion with minimal infrastructure demand

Faster threat detection and reduced false positives

Ensures compliance by conforming to FFIEC guidance

iFusionTM Fraud Analytics Engine

Client Success

Advanced fraud detection solution developed using iFusionTM platform helped a leading bank mitigate risk and reduce losses

The client needed a real-time fraud detection solution that can enable precautionary measures like step-up authentication

Download